Payment Gateways for Mobile Applications in 2024: All the Information You’ll Need

Without credit cards, it isn't easy to fathom modern life. It is easy to become addicted to this procedure since these little bits of plastic allow us to spend vast amounts so effortlessly. It's hardly surprising that a convenient payment method has become a monopoly, moving to mobile apps and websites. If you're interested in building a money-related app but need to become more familiar with integrating a mobile payment gateway, you've come to the perfect place! How to integrate payment gateway in App is topic covered in this article. The information you will acquire is as follows:

What is a Payment Gateway?

The only way to buy anything using a mobile app is through a Payment API Integration Development provider. The actual payment processor (a bank) and the customer's desired transaction are connected through it. Why are mediators necessary in the first place? We have implemented security measures to prevent direct interaction between our app and payment processors.

Thus, payment gateway solutions are an integral part of the app that enables secure processing of mobile app payments by encrypting sensitive data (such as PINs). If your company needs to incorporate payment choices into your app but wants to avoid taking on the responsibility of data security, a payment gateway is a good solution.

Prerequisites for Integrating a Mobile Payment Gateway

We already said there are a few quirks to be aware of before you develop payment gateway.

Types of Merchant Accounts to Choose

To begin, let's explore the concept of a merchant account in more detail. This account serves as a virtual bank for your company and lets you take payments online. If you have integrated a payment gateway system, the process begins with provider verification before the funds are transferred to your merchant account. After a short holding period (usually 2-7 days), the funds are transferred to your regular business bank account.

Not to add, as an optional extra, API Integration Development make it easier to process payments. They're security software that aids in preventing fraud and expanding the capabilities of online payment systems (like subscription support, for example). However, most merchant accounts also provide clients with basic security features and the ability to accept payments online.

Any bank can open a merchant account and, if required and supported, combine it with payment gateways. Another option is to open a merchant account with a centralized credit card processing provider, such as Stripe or PayPal.

Lastly, you should select one of these two merchant accounts based on your requirements.

Dedicated Merchant Account

Your company will be the only one that can use this particular type of merchant account. This option is both time-consuming and costly. Most of the time will be devoted to completing various checks, most of which are security-related.

However, with this choice, you may manage your money more precisely. One example is that your payment processing fee rates can be tailored to your sales volume. In other words, your fees decrease as your sales increase, and vice versa. The additional characteristics include more flexibility for financial operations, such as account debiting, error rectification during transactions, and faster money transfers (up to 3 days compared to 2-7 days with conventional account types). You can hire mobile app development services for your help.

Aggregate Merchant Account

You and other businesses share in the profits with this merchant account type. Imagine it as a shared bank cell that other individuals use.

As a result, you will have less say over your money, and transferring funds to the company account can take longer. Contrarily, this choice is relatively inexpensive. You can Hire Dedicated Mobile App Developers to assist you.

Types of Goods You Sell

Regarding integrating mobile app payments, the goods you sell are also a significant consideration. One must contend with the in-app purchase policies of the Play Store or the App Store if one intends to sell digital content. No third-party services can be used by the program distributed through those markets. That way, you can only make purchases using your Apple ID or Gmail account.

Developers can find the necessary instructions and resources from both companies. Google has developed an API specifically for Android developers, while Apple recommends a customized framework for iOS developers. Therefore, the App Store or Google Play will handle all transactions.

However, both systems suggest utilizing Mobile Application Payment Gateway providers if you intend to sell tangible things. With the help of dedicated APIs, a payment gateway can also integrate with your app.

Security Certificates

You need to be PCI DSS certified if you deal with customers' financial data. Even with the highly secure best payment gateway for mobile app, this certificate is still required. You have to go through a long verification process to obtain certification.

Ensuring your information system complies with PCI DSS requirements is the first order of business when dealing with customer credit card data. After pen-testers have identified security holes, the following step is to fix them.

One of the businesses with the accreditation of a Qualified Security Assessor will thoroughly assess your company after all the solutions have been implemented. They each reach their own decision on whether or not to certify your business.

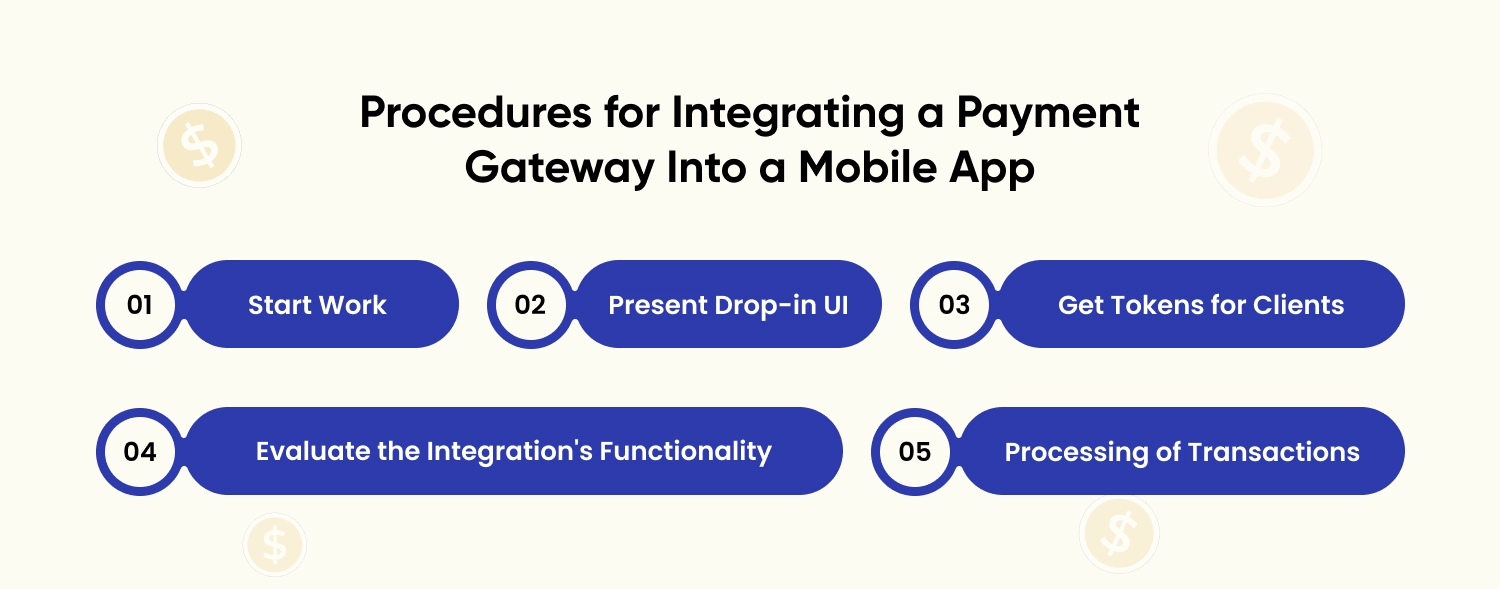

Procedures for Integrating a Payment Gateway Into a Mobile App

We used the implementation of the Braintree service on iOS and Android as an example to show how to achieve mobile app payment gateways.

Create more efficient payment solutions with the help of Braintree, a PayPal service. Mobile apps built with the Braintree SDK may take a variety of payment types, including major credit cards and alternative payment systems like Apple Pay and PayPal.

Now we'll look at the fundamental steps (iOS-based) for integrating payments into apps:

Start Work

Using build systems such as CocoaPods, Carthage, Swift Package Manager, etc., the developers must incorporate Braintree into the project.

Present Drop-in UI

Supplement the code with a few lines. You can construct a unique Ul and directly tokenize the credit card information. Customers can immediately tokenize their purchase information using tokenization keys, eliminating the need to generate a new key for each session.

Get Tokens for Clients

Your server must generate a client token in response to an app request. With each app restart, generate fresh client tokens. Customers can initialize the SDK using authorization data and tokens that hold the whole configuration.

Evaluate the Integration's Functionality

Braintree test card data and one-time-use numbers can be used to conduct testing. Create an account for the Braintree sandbox here. The public and private keys and the Sandbox merchant ID will make up your credentials.

Processing of Transactions

Make use of your server's one-time payment option to handle transactions. The process is as follows: once you have the client's card details, you send them to the server, and the server utilizes them to complete the purchase.

Payment gateway integration in mobile applications follows the same procedure. The main distinction is that the Android SDK installation requires developers to use a specific Braintree library.

Conclusion

Are you curious about the time required to incorporate payment features into the app? It usually takes around 40 hours to link your app to the payment gateway, and that's true across all providers. The next step is for the developers to evaluate the providers' upgraded capabilities on mobile apps that run on iOS and Android. The time required is twenty hours or more. In addition, ongoing technical assistance is necessary for payment gateway solutions. Keep an extra 5-10 hours a month on hand. Here is the perfect spot for you if you need help integrating a mobile payment gateway or have an app concept but need help knowing where to begin! Since 2011, our software development company has helped hundreds of entrepreneurs and businesses worldwide implement their ideas, thanks to our deep experience in mobile app payment integration.

Frequently Asked Questions

One key digital economy component is payment gateways, interfaces utilized to gather payment information from consumers. These solutions lower some hurdles to online commerce by enabling customers to transmit their credit card information securely.

Pricing is vital when choosing a payment gateway. Check the setup, monthly, and transaction fees. Some gateways, such as Razorpay, offer $0 setup costs for startups and small enterprises.

Safety is of the utmost importance while handling financial transactions. Verify that your payment gateway is currently secure. This includes fraud prevention, data encryption and tokenization, and PCI DSS compliance.

Thoroughly testing the system is vital before launching the integrated payment gateway in your mobile app to guarantee it performs effectively and safely. Most mobile payment integrations come with a sandbox where you can practice making fake purchases to ensure everything is working properly.

Transform Your Vision Into Reality.

Contact Us Now to Kickstart Your Mobile App Project!

Let's Discuss